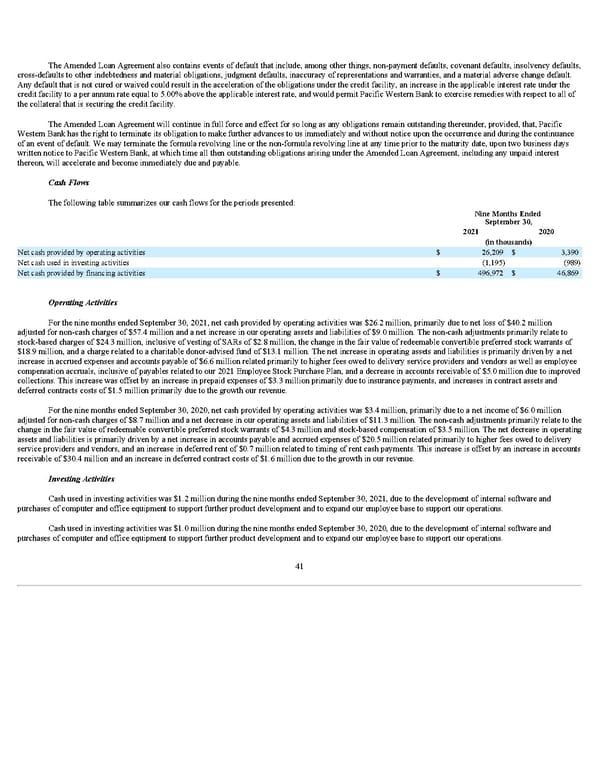

The Amended Loan Agreement also contains events of default that include, among other things, non-payment defaults, covenant defaults, insolvency defaults, cross-defaults to other indebtedness and material obligations, judgment defaults, inaccuracy of representations and warranties, and a material adverse change default. Any default that is not cured or waived could result in the acceleration of the obligations under the credit facility, an increase in the applicable interest rate under the credit facility to a per annum rate equal to 5.00% above the applicable interest rate, and would permit Pacific Western Bank to exercise remedies with respect to all of the collateral that is securing the credit facility. The Amended Loan Agreement will continue in full force and effect for so long as any obligations remain outstanding thereunder, provided, that, Pacific Western Bank has the right to terminate its obligation to make further advances to us immediately and without notice upon the occurrence and during the continuance of an event of default. We may terminate the formula revolving line or the non-formula revolving line at any time prior to the maturity date, upon two business days written notice to Pacific Western Bank, at which time all then outstanding obligations arising under the Amended Loan Agreement, including any unpaid interest thereon, will accelerate and become immediately due and payable. Cash Flows The following table summarizes our cash flows for the periods presented: Nine Months Ended September 30, 2021 2020 (in thousands) Net cash provided by operating activities $ 26,209 $ 3,390 Net cash used in investing activities (1,195) (989) Net cash provided by financing activities $ 496,972 $ 46,869 Operating Activities For the nine months ended September 30, 2021, net cash provided by operating activities was $26.2 million, primarily due to net loss of $40.2 million adjusted for non-cash charges of $57.4 million and a net increase in our operating assets and liabilities of $9.0 million. The non-cash adjustments primarily relate to stock-based charges of $24.3 million, inclusive of vesting of SARs of $2.8 million, the change in the fair value of redeemable convertible preferred stock warrants of $18.9 million, and a charge related to a charitable donor-advised fund of $13.1 million. The net increase in operating assets and liabilities is primarily driven by a net increase in accrued expenses and accounts payable of $6.6 million related primarily to higher fees owed to delivery service providers and vendors as well as employee compensation accruals, inclusive of payables related to our 2021 Employee Stock Purchase Plan, and a decrease in accounts receivable of $5.0 million due to improved collections. This increase was offset by an increase in prepaid expenses of $3.3 million primarily due to insurance payments, and increases in contract assets and deferred contracts costs of $1.5 million primarily due to the growth our revenue. For the nine months ended September 30, 2020, net cash provided by operating activities was $3.4 million, primarily due to a net income of $6.0 million adjusted for non-cash charges of $8.7 million and a net decrease in our operating assets and liabilities of $11.3 million. The non-cash adjustments primarily relate to the change in the fair value of redeemable convertible preferred stock warrants of $4.3 million and stock-based compensation of $3.5 million. The net decrease in operating assets and liabilities is primarily driven by a net increase in accounts payable and accrued expenses of $20.5 million related primarily to higher fees owed to delivery service providers and vendors, and an increase in deferred rent of $0.7 million related to timing of rent cash payments. This increase is offset by an increase in accounts receivable of $30.4 million and an increase in deferred contract costs of $1.6 million due to the growth in our revenue. Investing Activities Cash used in investing activities was $1.2 million during the nine months ended September 30, 2021, due to the development of internal software and purchases of computer and office equipment to support further product development and to expand our employee base to support our operations. Cash used in investing activities was $1.0 million during the nine months ended September 30, 2020, due to the development of internal software and purchases of computer and office equipment to support further product development and to expand our employee base to support our operations. 41

Q3 2021 10Q Page 46 Page 48

Q3 2021 10Q Page 46 Page 48