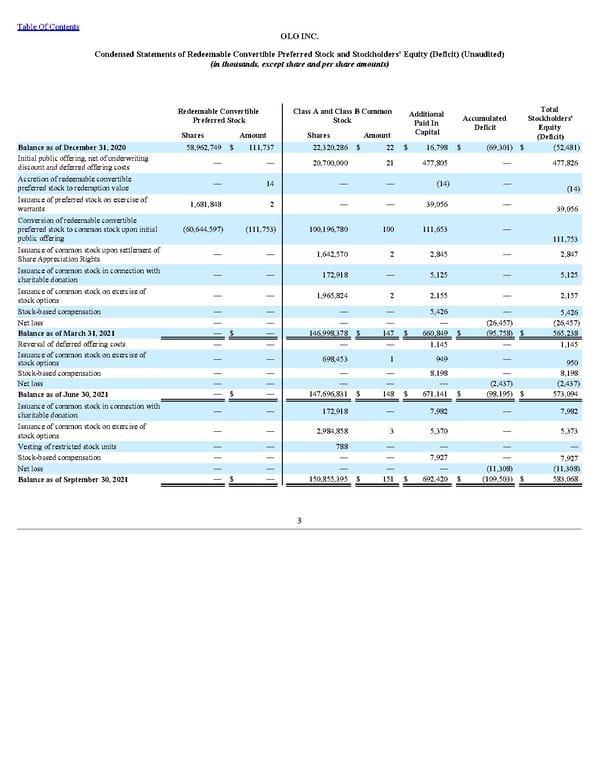

Table Of Contents OLO INC. Condensed Statements of Redeemable Convertible Preferred Stock and Stockholders' Equity (Deficit) (Unaudited) (in thousands, except share and per share amounts) Redeemable Convertible Preferred Stock Class A and Class B Common Stock Additional Paid In Capital Accumulated Deficit Total Stockholders' Equity (Deficit) Shares Amount Shares Amount Balance as of December 31, 2020 58,962,749 $ 111,737 22,320,286 $ 22 $ 16,798 $ (69,301) $ (52,481) Initial public offering, net of underwriting discount and deferred offering costs — — 20,700,000 21 477,805 — 477,826 Accretion of redeemable convertible preferred stock to redemption value — 14 — — (14) — (14) Issuance of preferred stock on exercise of warrants 1,681,848 2 — — 39,056 — 39,056 Conversion of redeemable convertible preferred stock to common stock upon initial public offering (60,644,597) (111,753) 100,196,780 100 111,653 — 111,753 Issuance of common stock upon settlement of Share Appreciation Rights — — 1,642,570 2 2,845 — 2,847 Issuance of common stock in connection with charitable donation — — 172,918 — 5,125 — 5,125 Issuance of common stock on exercise of stock options — — 1,965,824 2 2,155 — 2,157 Stock-based compensation — — — — 5,426 — 5,426 Net loss — — — — — (26,457) (26,457) Balance as of March 31, 2021 — $ — 146,998,378 $ 147 $ 660,849 $ (95,758) $ 565,238 Reversal of deferred offering costs — — — — 1,145 — 1,145 Issuance of common stock on exercise of stock options — — 698,453 1 949 — 950 Stock-based compensation — — — — 8,198 — 8,198 Net loss — — — — — (2,437) (2,437) Balance as of June 30, 2021 — $ — 147,696,831 $ 148 $ 671,141 $ (98,195) $ 573,094 Issuance of common stock in connection with charitable donation — — 172,918 — 7,982 — 7,982 Issuance of common stock on exercise of stock options — — 2,984,858 3 5,370 — 5,373 Vesting of restricted stock units — — 788 — — — — Stock-based compensation — — — — 7,927 — 7,927 Net loss — — — — — (11,308) (11,308) Balance as of September 30, 2021 — $ — 150,855,395 $ 151 $ 692,420 $ (109,503) $ 583,068 3

Q3 2021 10Q Page 8 Page 10

Q3 2021 10Q Page 8 Page 10