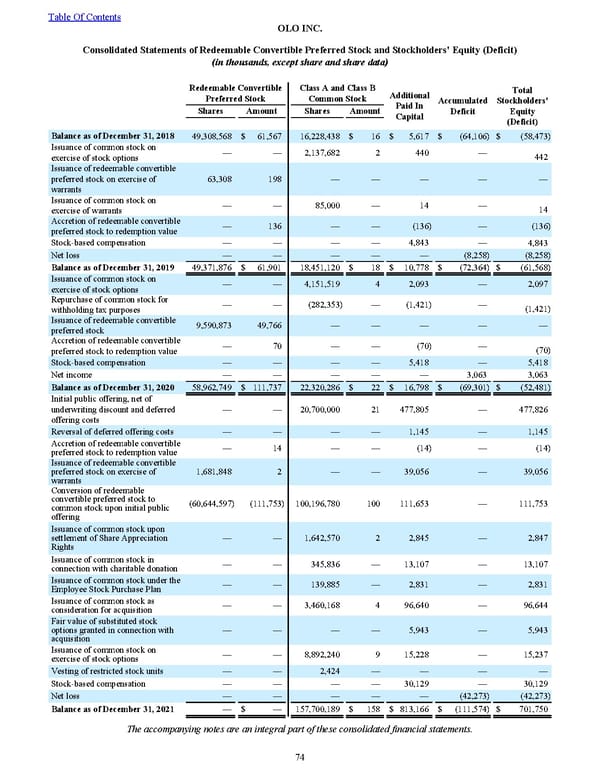

Redeemable Convertible Preferred Stock Class A and Class B Common Stock Additional Paid In Capital Accumulated Deficit Total Stockholders' Equity (Deficit) Shares Amount Shares Amount Balance as of December 31, 2018 49,308,568 $ 61,567 16,228,438 $ 16 $ 5,617 $ (64,106) $ (58,473) Issuance of common stock on exercise of stock options — — 2,137,682 2 440 — 442 Issuance of redeemable convertible preferred stock on exercise of warrants 63,308 198 — — — — — Issuance of common stock on exercise of warrants — — 85,000 — 14 — 14 Accretion of redeemable convertible preferred stock to redemption value — 136 — — (136) — (136) Stock-based compensation — — — — 4,843 — 4,843 Net loss — — — — — (8,258) (8,258) Balance as of December 31, 2019 49,371,876 $ 61,901 18,451,120 $ 18 $ 10,778 $ (72,364) $ (61,568) Issuance of common stock on exercise of stock options — — 4,151,519 4 2,093 — 2,097 Repurchase of common stock for withholding tax purposes — — (282,353) — (1,421) — (1,421) Issuance of redeemable convertible preferred stock 9,590,873 49,766 — — — — — Accretion of redeemable convertible preferred stock to redemption value — 70 — — (70) — (70) Stock-based compensation — — — — 5,418 — 5,418 Net income — — — — — 3,063 3,063 Balance as of December 31, 2020 58,962,749 $ 111,737 22,320,286 $ 22 $ 16,798 $ (69,301) $ (52,481) Initial public offering, net of underwriting discount and deferred offering costs — — 20,700,000 21 477,805 — 477,826 Reversal of deferred offering costs — — — — 1,145 — 1,145 Accretion of redeemable convertible preferred stock to redemption value — 14 — — (14) — (14) Issuance of redeemable convertible preferred stock on exercise of warrants 1,681,848 2 — — 39,056 — 39,056 Conversion of redeemable convertible preferred stock to common stock upon initial public offering (60,644,597) (111,753) 100,196,780 100 111,653 — 111,753 Issuance of common stock upon settlement of Share Appreciation Rights — — 1,642,570 2 2,845 — 2,847 Issuance of common stock in connection with charitable donation — — 345,836 — 13,107 — 13,107 Issuance of common stock under the Employee Stock Purchase Plan — — 139,885 — 2,831 — 2,831 Issuance of common stock as consideration for acquisition — — 3,460,168 4 96,640 — 96,644 Fair value of substituted stock options granted in connection with acquisition — — — — 5,943 — 5,943 Issuance of common stock on exercise of stock options — — 8,892,240 9 15,228 — 15,237 Vesting of restricted stock units — — 2,424 — — — — Stock-based compensation — — — — 30,129 — 30,129 Net loss — — — — — (42,273) (42,273) Balance as of December 31, 2021 — $ — 157,700,189 $ 158 $ 813,166 $ (111,574) $ 701,750 The accompanying notes are an integral part of these consolidated financial statements. Table Of Contents OLO INC. Con solidated Statements of Redeemable Convertible Preferred Stock and Stockholders' Equity (Deficit) (in thousands, except share and share data) 74

2022 10K Page 80 Page 82

2022 10K Page 80 Page 82